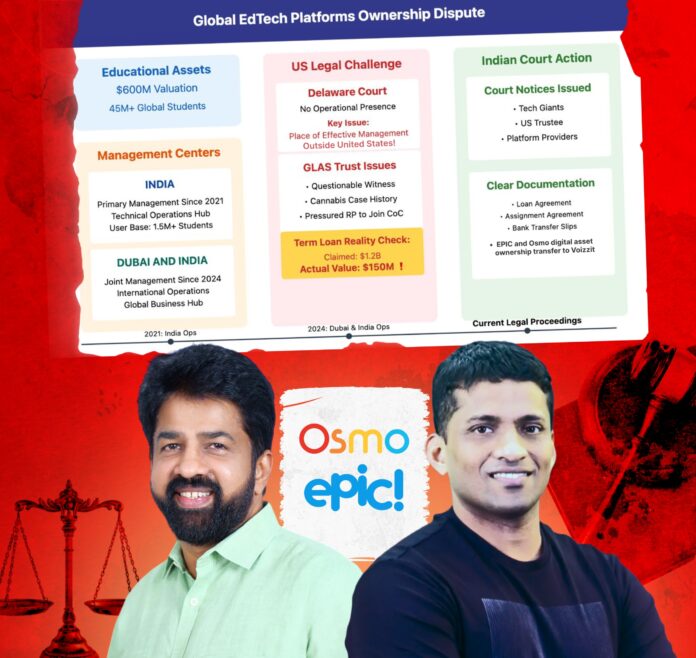

ERNAKULAM (Kerala): In a move that could reshape the landscape of international digital asset disputes, the Commercial Court at Ernakulam has issued notices to multiple parties, including US-based Chapter 11 Trustee Claudia Springer and major tech companies, in a case challenging the jurisdiction of Delaware courts over educational platforms Epic and Osmo.

The lawsuit, filed by Voizzit Information Technology LLC and Rajendran Vellapalath, seeks to establish ownership rights over getepic.com and playosmo.com – platforms serving over 45 million students globally. These assets were valued at over $500 million when initially acquired by BYJU’S in 2021.

Jurisdictional Battle and Financial Complexities

The dispute centers on Vellapalath’s assertion that the platforms’ place of effective management has been based in India since Think & Learn’s 2021 acquisition and subsequently in Dubai since April 2024. Through a $100 million loan assignment arrangement, Voizzit acquired significant rights over Epic and Osmo.

At the heart of the controversy lies a term loan facility to Think and Learn (Byju’S parent company), now valued at $150 million according to records – significantly less than its original $1.2 billion face value. This valuation emerged from a term sheet presented by William Hailer to Vellapalath during a meeting at Byju’s Dubai residence.

Creditor’s Controversial Tactics Surface

Court documents have revealed troubling tactics employed by GLAS Trust Company LLC, representing Byju’s lenders. Between July 31 and August 21, 2024, GLAS’s legal representatives reportedly exerted “intense pressure” on the Resolution Professional to include them in the Committee of Creditors (CoC), despite questionable claim status.

The Resolution Professional ultimately rejected GLAS’s position, classifying their claim as contingent and excluding them from the CoC. This decision followed careful review of multiple objections, including concerns about unsigned credit agreements and pending applications.

GLAS Trust’s case faced further scrutiny over their reliance on William Hailer as sole witness in Delaware proceedings. Hailer, recently involved in a cannabis industry legal case concluded in August 2024, provided testimony that Vellapalath has contested with documented evidence, raising serious credibility concerns.

Educational Impact and Technical Complexity

The dispute’s implications extend beyond legal boardrooms to millions of students and teachers worldwide. Critical software updates hang in the balance, threatening potential disruption to these essential learning platforms.

The Ernakulam court’s notices to tech giants including Apple, Google, and Cloudflare highlight the case’s technical intricacy. These companies provide crucial infrastructure for the platforms’ operations, from app store presence to cloud services.

“The fundamental issue here is about territorial jurisdiction and rightful ownership,” explains a senior legal expert familiar with the case. “When a company’s place of effective management is clearly outside US borders, it raises important questions about the reach of US bankruptcy proceedings.”

Looking Ahead

As proceedings unfold in India, the case could establish significant precedents for international technology ownership disputes, particularly where platforms operate globally but are managed across multiple jurisdictions.

The Commercial Court at Ernakulam’s involvement marks a crucial step toward resolving the ownership dispute. Their examination of the platforms’ operational and management history will be central to determining rightful ownership, with potential implications for future digital asset disputes worldwide.