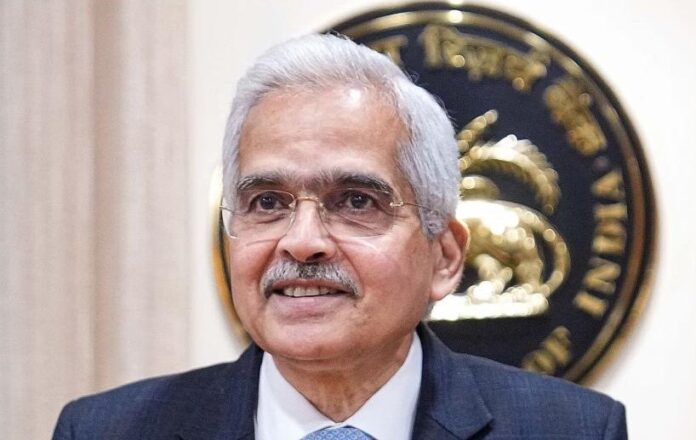

Reserve Bank of India Governor Shaktikanta Das held a meeting with the major stakeholders in the UPI ecosystem on Wednesday.

The stakeholders included banks, National Payments Corporation of India (NPCI), third party application providers and technology service providers, and discussions centered around potential strategies for further expanding the reach of UPI.

The meeting was also attended by RBI Deputy Governor T Rabi Sankar along with senior officials of RBI.

There were wide ranging discussions on various aspects to widen and deepen the adoption and usage of UPI, RBI said in a press release.

The stakeholders shared their valuable inputs and suggestions, covering strategies for scaling up of UPI infrastructure and expanding products portfolio.

Challenges being encountered by the ecosystem and innovative solutions for addressing the same; and innovative ideas to integrate potential users into the digital payments ecosystem were also part of the discussion.

“The various suggestions received will be examined and suitable action will be initiated in due course by the Reserve Bank,” said the Reserve Bank of India.

Payments through digital means in India are hitting fresh highs, as its citizens are increasingly adopting the emerging modes of transacting on the internet.

The UPI payment system has become hugely popular for retail digital payments in India, and its adoption is increasing at a rapid pace.

UPI is India’s mobile-based fast payment system, which facilitates customers to make round-the-clock payments instantly, using a Virtual Payment Address (VPA) created by the customer. The UPI payment system has become hugely popular for retail digital payments in India, and its adoption is increasing at a rapid pace.

Among others, a key emphasis of the Indian government has been on ensuring that the benefits of UPI are not limited to India only; other countries, too, benefit from it. So far, Sri Lanka, Mauritius, France, UAE, and Singapore, among others, have partnered or intending to partner with India on emerging fintech and payment solutions.

The share of UPI in digital payments in India has reached close to 80 per cent in 2023. Today, India accounts for nearly 46 per cent of the world’s digital transactions (as per 2022 data).